350 billion dollars! The largest merger in the history of chemical industry may be born!

Release time: 2021-02-05 Click on the quantity:1286Recently, the "Wall Street Journal" reported that Exxon Mobil is discussing a merger with Chevron, another US oil company. If the deal is concluded, it may be one of the largest corporate mergers in history.

According to Dow Jones reports, Exxon Mobil CEO Darren Woods and Chevron CEO Mike Wirth had a preliminary discussion on the merger in early 2020.

Foreign media news stated that the meeting was described as preliminary and added that the discussion may take place in the future.

Chevron CEO Voss did not comment on the merger, but he also admitted that if the two companies merge, it can improve industry efficiency. He said that such large-scale mergers and acquisitions have not happened, "time will tell." Looking at it now, they do have this idea.

Largest merger

ExxonMobil’s market value is US$190 billion, Chevron’s market value is US$164 billion, and the combined size will reach US$350 billion. It will become the world’s second largest oil company by market value and production, second only to Saudi Aramco and Saudi Arabia. The market value of Aramco is approximately US$1.8 trillion. Calculated at the level before the epidemic, the combined company's daily oil production can reach about 7 million barrels.

The scale of this transaction will far exceed the mergers of large oil companies that occurred in the late 1990s and early 2000s, including Exxon and Mobil, Chevron and Texaco Inc. .) The merger.

This may also be the largest business merger in history. Dealogic's data shows that this record is currently maintained by the Vodafone Group's acquisition of the German company Mannesmann AG's exchange for US$181 billion in 2000.

In 2020, the oil industry completed several large mergers and acquisitions, including Chevron’s US$5 billion acquisition of Noble Energy Inc., and ConocoPhillips’ US$9.7 billion acquisition of Concho Resources Inc. .).

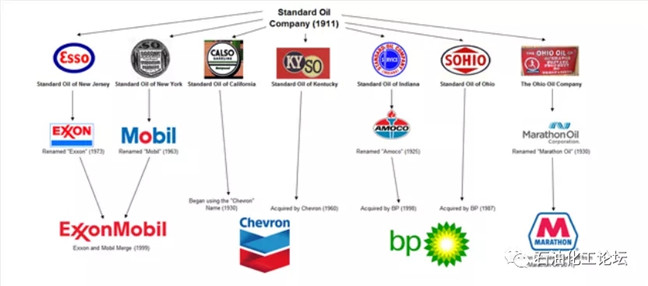

This is "a family"

Exxon Mobil and Chevron were originally "a family". In 1911, due to the US anti-monopoly law, the Standard Oil Monegority founded by Rockefeller was divided into three larger oil companies (New Jersey Standard, New York Standard, California Standard) and four other original oil companies . Among them are Mobil, Exxon and Chevron.

The Seven Sisters of the petroleum industry dominated the global petroleum industry from the mid-1940s to the mid-1970s. Before the 1973 oil crisis, the Seven Sisters controlled about 85% of the world's oil reserves.

Huge financial pressure

According to Reuters, the discussions between the two companies on the merger show that the energy industry giants are facing tremendous pressure under heavy shocks. Last year, the stock prices of the two oil giants plummeted. Exxon Mobil's stock price fell nearly 29% and Chevron's stock price fell nearly 20%.

Both Exxon Mobil and Chevron are facing tremendous financial pressure. 2020 is one of ExxonMobil's worst financial years in history. In the first three quarters of 2020, the company had a total loss of more than $2 billion. The company will announce its results for the fourth quarter of 2020 on February 1, local time, and is expected to experience a loss for the fourth consecutive quarter. Chevron is also struggling, and its financial report data released last Friday showed that the loss in 2020 is close to 5.5 billion US dollars.

Standard & Poor's Global Market Intelligence (S&P Global Market Intelligence) data show that as of September, Exxon Mobil’s debt was approximately US$69 billion and Chevron’s debt was approximately US$35 billion.

However, some investors are increasingly worried about ExxonMobil’s development direction under Woods' leadership, because the company is facing rapid changes in the energy industry and global awareness of climate change is also increasing. Some people are also worried that ExxonMobil may be unable to maintain a high dividend of about $15 billion a year due to high debt levels.

The company’s dilemma has attracted the attention of investors. One of them, Engine No.1 LLC, advocates that the company should focus more on investments in clean energy, while cutting costs in other areas in order to maintain dividends. Exxon Mobil nominated four directors to the board of directors last Wednesday and called for a strategic adjustment of its business plan. There was also news last month that Exxon Mobil has been negotiating with the hedge fund D.E. Shaw and is preparing to announce the addition of new board members, further cuts in expenses and investment in new technologies to help it reduce carbon emissions.

What are the benefits of merging?

Many investors, analysts, and energy executives have called for further consolidation in the oil industry, cutting costs and improving operational efficiency will help companies survive the economic recession triggered by the epidemic and prepare for an uncertain future.

Energy analyst Paul Sankey (Paulsankey) first proposed the idea of merging Chevron and ExxonMobil in October last year. He said that the combined company has a market value of approximately US$300 billion and debt of approximately US$100 billion. Through the merger, the two companies can cut a total of 15 billion US dollars in management expenses and 10 billion US dollars in annual capital expenditures.

Some analysts pointed out that the merger of the two companies to become the world's second largest oil company may change the global energy market.

Last year, the oil price war between Saudi Arabia and Russia, the world's top oil exporter, caused a panic plunge in international oil prices, which dealt a heavy blow to the US oil industry and caused a large number of US companies to go bankrupt, lay off their employees, and be forced to merge.

Reuters said that the price war highlighted the vulnerability of American oil companies. Compared with other countries, the U.S. government has limited ability to intervene in oil companies. There is a competitive relationship among U.S. oil companies, and different production targets are set. If the two companies merge, it will be the best opportunity for the US oil giants to compete against Saudi Arabia and other large state-owned oil companies.

In the long run, the further integration of the oil industry can also prepare for future uncertainty and transformation. Many countries are reducing their dependence on fossil fuels in response to climate change.

Unlike its European counterparts, BP and Shell, Exxon Mobil and Chevron did not make substantial investments in renewable energy, but chose to double their investment in oil and gas projects. Both companies believe that the world will need a lot of fossil fuels in the next few decades, and the current lack of investment in oil production will cause a contradiction between supply and demand.

Copyright: Zhejiang Everstand Mechanical Engineering Co.,Ltd Tel:+86-574-86111527 E-mail:nbcy2006@163.com Power by mdcm