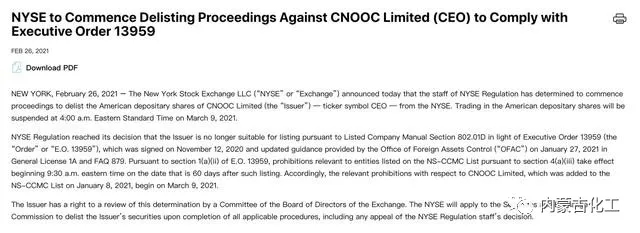

Burst! The New York Stock Exchange in the United States: Initiated a delisting and delisting procedure for the Chinese chemical giant, or ceased trading on March 9

Release time: 2021-03-03 Click on the quantity:1513On February 26th, local time in the United States, the New York Stock Exchange announced the initiation of a delisting "delisting" procedure for the Chinese chemical giant, China National Offshore Oil Corporation. Inner Mongolia Chemical's WeChat official account learned that the move is to implement an executive order signed by former U.S. President Donald Trump in November 2020, which prohibits Americans from investing in companies connected to the Chinese military.

According to the guidelines issued by the U.S. Department of the Treasury on January 27, 2021, the investment ban will take effect 60 days after CNOOC is included in the investment "blacklist". Therefore, trading of CNOOC’s American Depositary Shares will be suspended at 4 a.m. on March 9.

A person familiar with the matter told the WeChat official account of Inner Mongolia Chemical that the former President Trump’s executive order prohibits investment in dozens of Chinese companies. These companies were blacklisted by the U.S. Department of Defense in 2020. The U.S. accused them of cooperating with the People’s Liberation Army. Threats to American security.

However, the New York Stock Exchange also stated that CNOOC Limited has the right to appeal the delisting decision. The exchange will include any complaints received in its application report to the US Securities and Exchange Commission. The exchange will submit an application report after all delisting procedures are completed.

According to sources, the NYSE will have such actions in the next step, and Biden is also fully evaluating a series of sanctions against China taken by Trump in the final year of his term. In 2020, the U.S. Department of Commerce also included CNOOC on another blacklist, the so-called "entity list," which forced U.S. companies to stop selling products and technologies to China National Petroleum Corporation.

China's other two major chemical giants PetroChina (00857-HK) and Sinopec (00386-HK) may also be required to delist, because the United States is very afraid of the energy industry's support for the Chinese military.

US Government Press Secretary Jen Psaki (Jen Psaki) said that the White House is conducting a series of "complex reviews" on Trump's sanctions in China.

At the end of 2020, the NYSE said it would implement Trump’s executive order on the delisting of China’s three major telecom operators. At that time, the China Securities Regulatory Commission responded that the status of the United States as an international financial center depends on the trust of global companies and investors in the inclusiveness and certainty of its rules and systems.

The Chinese side stated that some political forces in the United States have not hesitated to damage the global position of the US capital market and continue to unprovoked suppression of foreign companies listed in the United States. This reflects the arbitrariness, willfulness, and uncertainty of the rules and systems. This is unwise. We hope that the US will respect the market, respect the rule of law, and do more to maintain the order of the global financial market, protect the legitimate rights and interests of investors, and contribute to the stable development of the global economy.

Copyright: Zhejiang Everstand Mechanical Engineering Co.,Ltd Tel:+86-574-86111527 E-mail:nbcy2006@163.com Power by mdcm